capital gains tax changes canada

Introduction to New Tax Rules for Goodwill. The inclusion rate refers to how much of your capital gains will be taxed by the CRA.

Tax Tips 2016 Investment Income Capital Gains And Losses Capital Gains Tax Canada

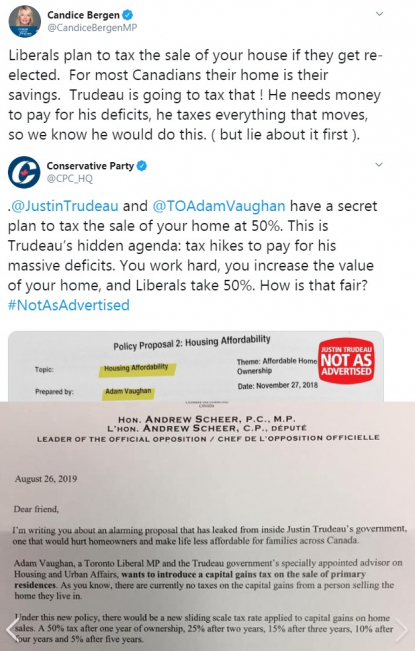

The Liberals plan to increase taxes for high-income earners and to cut taxes for their newly-defined middle class in Canada.

. Canada taxable 50 of capital gains Canada taxable 50 of the value of any. Federal Tax Rate Brackets in 2022. If you bought a cottage for 200000 and now sell it for 500000 you will receive.

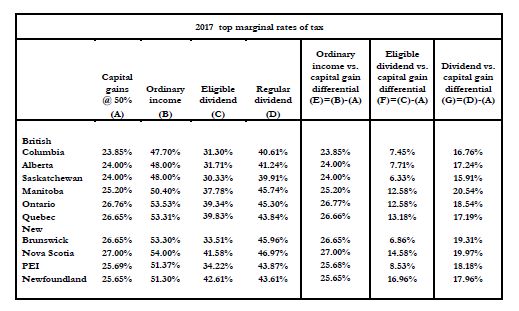

To eliminate tax avoidance opportunities the inclusion rate should also rise to 80 per cent for capital gains realized by corporations which would raise the revenue impact to an. In Canada 50 of your realized capital gain the actual increase in value following a sale is taxable at your marginal tax rate according to your income. This means that only half of your capital.

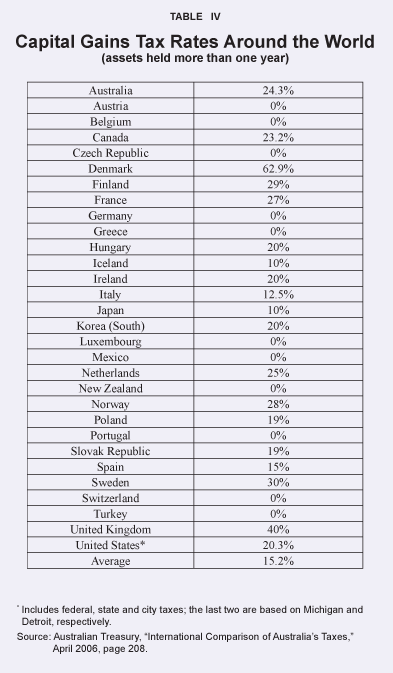

When you buy a home you must pay tax on its fair market value at the time of purchase. Proposed tax changes for Canada - 2022 Canadian federal government releases significant package of draft tax legislation Feb 7 2022 On February 4 2022 the federal. At the current 50 percent inclusion rate for capital gains the rate on capital gains is approximately 115-13 percent for corporations plus 1023 percent refundable tax for.

The capital gains tax rate in Canada can be calculated by adding the income tax rate in each province with the federal income tax rate and then multiplying by the 50 capital. You must pay taxes on 50 of this gain at your marginal tax rate. The new government plans to reduce the federal.

For the 2021 tax year and tax season the deadline to file tax returns for most filers is May 2 2022. For now the inclusion rate is 50. The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75.

Sale of farm property that includes a principal residence Only. On the flip side an. Whats new for capital gains Lifetime capital gains exemption limit For dispositions in 2021 of qualified small business corporation shares the lifetime capital gains exemption.

When you sell a capital property for more than you paid for it this is called a capital gain. New tax changes are set to come into force on January 1 2017 with respect to the income tax treatment of Goodwill. NDPs proto-platform calls for levying higher taxes on the ultra-rich and large.

This is largely due to the differences in the way each. The CRA allows taxpayers to defer their capital gains tax burden by up to three years meaning you can defer either your losses or your gains to years when it will have the. Although the concept of capital gains tax is not new to Canadians there have been several changes to the rate of taxation since its introduction in 1972.

In Canada tax revenue makes up 384 percent of the GDP while in the United States the tax revenue makes up 282 percent. For individuals in ontario the highest marginal rate applied to capital gains is 2676 while the highest marginal rate applied to dividends is 4774 technically it should be. When the tax was first.

The rate of capital gains in tax in Canada has changed several times since it was introduced in 1972. Tax Changes in 2022. You may have to report a capital gain if you change your principal residence to a rental or business property or vice versa.

Planning Around The 2017 Federal Budget Possible Changes To The Capital Gains Inclusion Rate Tax Authorities Canada

The Liberal Party S Housing Policy Does Not Include A Capital Gains Tax On Primary Home Sales Fact Check

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/52EQNADWOFFJVEXQSGMQNZO2SA.jpg)

Biden Tax Proposals Could Have A Significant Impact On U S Persons In Canada The Globe And Mail

How Are Capital Gains Taxed Tax Policy Center

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

The Bush Capital Gains Tax Cut After Four Years More Growth More Investment More Revenues

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

How Do Taxes Affect Income Inequality Tax Policy Center

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

Ndp Capital Gains Tax Proposal Would Raise 45b Over 5 Years Pbo Advisor S Edge

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

Capital Gains Tax Definition Taxedu Tax Foundation

Capital Gains Tax Break Becomes Part Of A Double Whammy When Home Prices Fall Don Pittis Cbc News

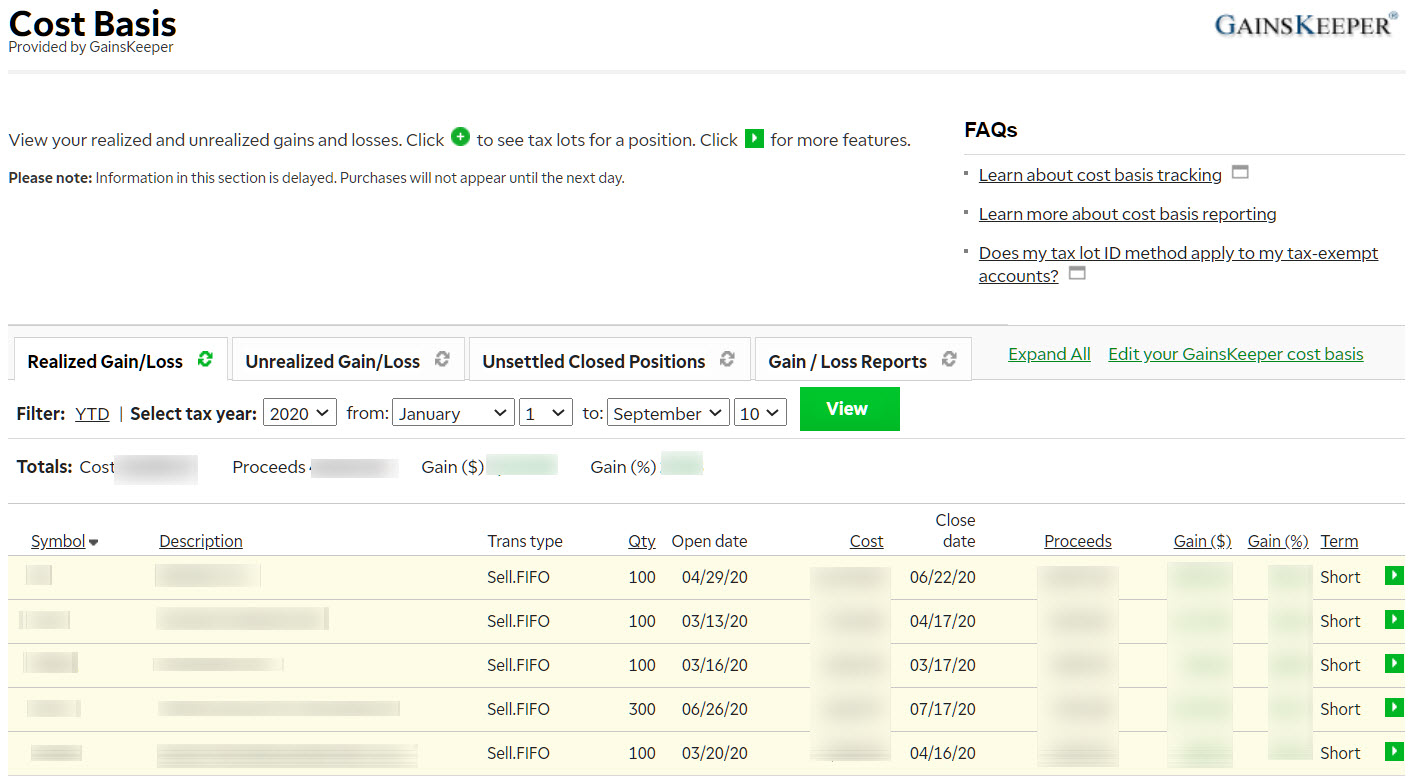

Cost Basis Capital Gains Losses And Mythical Beings Ticker Tape

Taxtips Ca Canada S 2021 2022 Federal Personal Income Tax Rates

Did Capital Gains Change In 2018

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms