how long does the irs have to collect back payroll taxes

Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. See if you Qualify for IRS Fresh Start Request Online.

Back Tax Returns Tax Debt Advisors

After that the debt is wiped clean from its books and the IRS.

. Owe IRS 10K-110K Back Taxes Check Eligibility. This means that the IRS can attempt to collect your unpaid taxes for up to ten years from the date. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt.

One option is a short-term payment plan of up to 180 days available for individual taxpayers who owe up to 100000 in combined tax penalties and interest. The IRS has a set collection period of 10. Ad Use our tax forgiveness calculator to estimate potential relief available.

After this 10-year period or statute of limitations has expired the IRS can no. Ad Owe back tax 10K-200K. Put simply the statute of limitations on federal tax debt is 10 years from the date of tax assessment.

Ad Owe back tax 10K-200K. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. Ad Use our tax forgiveness calculator to estimate potential relief available.

Get free competing quotes from the best. We Can Help Suspend Collections Liens Levies Wage Garnishments. Ad Worry-Free Tax Solutions.

The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection. Under Federal law there is a time restriction on how long the IRS has to collect unpaid taxes. If the IRS shows up after that you may be able to say the statute of limitations has run.

The IRS takes failure to pay payroll taxes especially with respect to active businesses very seriously and often assigns field agents to stop businesses that accrue payroll tax liability over. If you cannot pay. If you dont pay on time.

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. If you are unable to pay at this time 3 How long we have to collect taxes 3 How to appeal an IRS decision4. The IRS started accepting 2021 tax returns on Jan.

Time Limits on the IRS Collection Process. Resolve your back tax issues permanently. Ad Dont Face the IRS Alone.

This time restriction is most commonly known as the statute of limitations. Understanding collection actions 4 Collection actions in. The IRS has not yet released its 2022 refund schedule but you can use the chart below to estimate when you may.

This means the IRS should. How long can the IRS collect back taxes. See How for Back Taxes Help.

The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you. Owe IRS 10K-110K Back Taxes Check Eligibility. In most cases the IRS has three years to audit you after you file your return.

Get A Free IRS Back Tax Resolution Consultation. See if you Qualify for IRS Fresh Start Request Online. Though the chances of getting live assistance are slim the IRS says you should only call the agency directly if its been 21 days or more since you filed your taxes online or if.

As a general rule there is a ten year statute of limitations on IRS collections. There is an IRS statute of limitations on collecting taxes.

How Do I Get My Irs Tax Debt Forgiven Fortress Tax Relief

Irs Tax Refunds What Is Irs Treas 310 Marca

What Does The Irs Do And How Can It Be Improved Tax Policy Center

Offer In Compromise Acceptance Letter Offer In Compromise Debt Relief Programs Tax Debt

Tax Consolidation Irs Debt Relief Help From Licensed Professionals

Irs Sets Guidelines Based Off Trump S New Payroll Tax

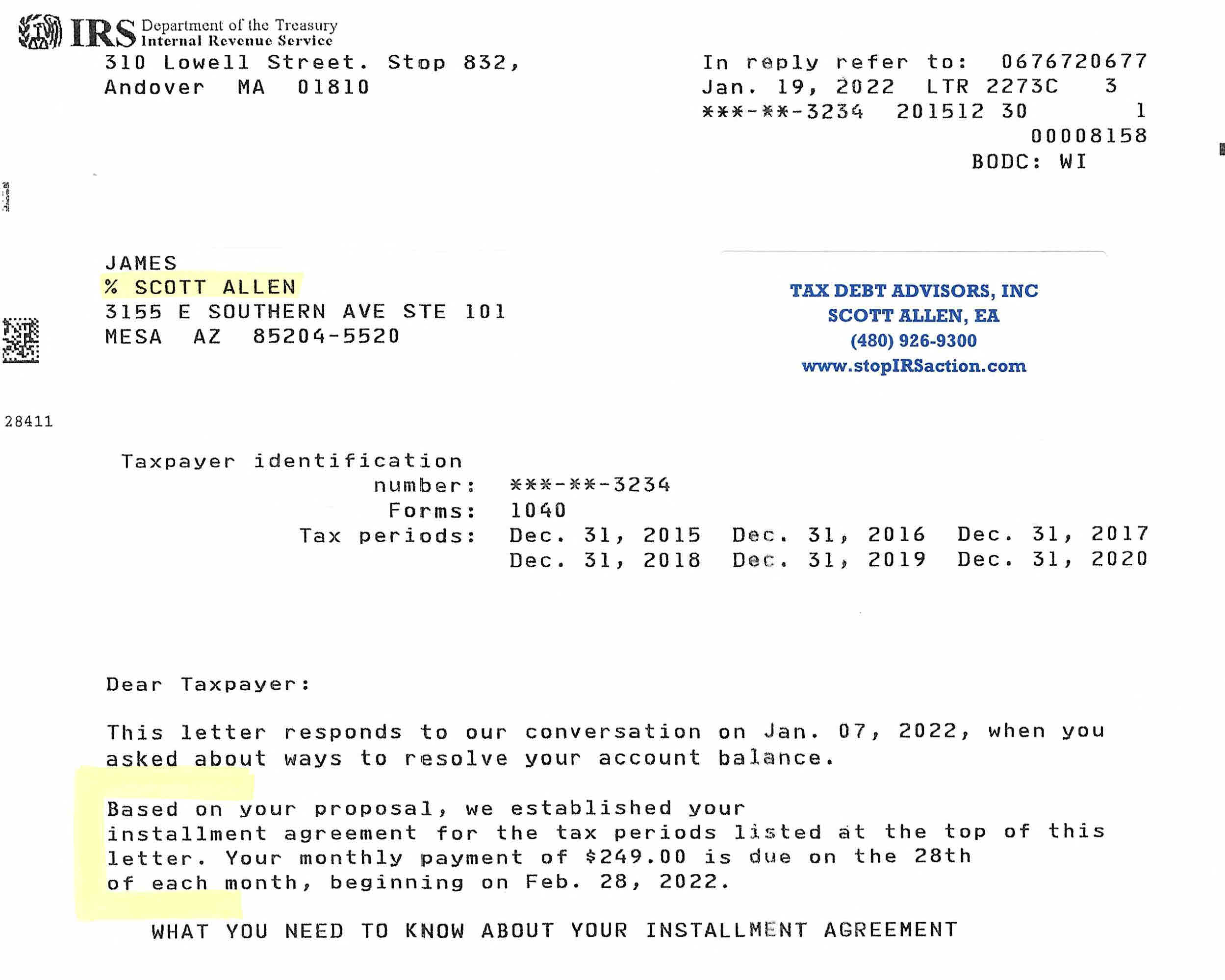

Irs Tax Letters Explained Landmark Tax Group

How Long Can The Irs Try To Collect A Debt

Winchester Va Irs Tax Problems Help Kilmer Associates Cpa P C

Irs One Time Forgiveness Program Everything You Need To Know

Can The Irs Collect After 10 Years Fortress Tax Relief

Owe The Irs You Have A Few Options If You Cannot Afford The Bill Forbes Advisor

Santa Clara California Irs Tax Problems Help Nri Tax Group

A Brief Guide On How To Stop An Irs Levy Irs Irs Taxes Tax Debt

Are There Statute Of Limitations For Irs Collections Brotman Law

Faqs On Tax Returns And The Coronavirus

What To Do If You Receive A Irs Tax Lien Notice What Are Your Options Irs Fresh Start Program Helpline 1 877 788 2937 Tax Relief Blog May 3 2016

When Does An Irs Tax Lien Expire Rjs Law Tax And Estate Planning